The majority of the small, workshop-style businesses in the Turkish furniture industry use conventional methods. However, the number of small, medium and large-scale businesses has started to rise, particularly in recent years.

In line with the level of employment, it is believed that fabricated production firms are made up of large firms. The number of businesses producing fabricated goods is rising daily.

Despite the fact that the sector does not have a significant presence for furniture or forestry products, more foreign-owned businesses are emerging, particularly in the kitchen furniture industry. The retail stores opened by IKEA in Istanbul, Izmir, Bursa, and Ankara has given the industry a boost. The furniture industry is concentrated in some areas of Turkey with a concentrated market and/or a high concentration of forest products. According to their contributions to total production, the major furniture-producing regions are Istanbul, Ankara, Bursa (İnegöl), Kayseri, Izmir, and Adana. Although Istanbul's furniture industry is dispersed throughout the city, the two most significant hubs are Masko in the Kitelli Organized Industrial Zone and Modoko, a furniture manufacturing facility in Ümraniye.

Ankara has long been a significant hub for the manufacture of furniture. TurkStat data show that it trails Istanbul in terms of both the number of businesses and total employment. The Siteler district in Ankara is known for its furniture industry. Siteler is a substantially organized industrial zone that covers 5,000 decares of land and was founded in the 1960s with the help of the Chamber of Carpenters. There are numerous small and medium-sized furniture manufacturing businesses in the area. Over 10,000 companies are thought to be located at the sites. However, these businesses require a lot of labor, and there aren't many of them producing in large quantities.

The wood industry has grown quickly in the Bursa-İnegöl Region, which has large forested areas and is another region with high development dynamics. İnegöl, which is now a furniture hub, made the most of the commercial mobility provided by its location along the historic Silk Road and the benefit of being close to resources for raw materials. In terms of employment, the Bursa-İnegöl furniture sector comes in second place to Ankara. However, according to our regions, it comes in third place in the export distribution of the sector, behind Kayseri and Istanbul. The region's export success demonstrates that Bursa-İnegöl is on the right path to becoming a significant global center for furniture.

Sofas, chairs, and beds were the first items produced in Kayseri as the furniture industry grew. Nowadays, thanks to technological advancements and fresh investments, Kayseri has developed into a significant furniture hub in Turkey, with businesses producing in all furniture-related fields. The largest businesses in the sector are located in Kayseri, according to TOBB data and TURKSTAT export statistics. Of these, 400 or so are mass-production fabrication firms with an export focus. The region employs 11.5 employees per firm, which is significantly more than Turkey's average. The high concentration of large-scale businesses in Kayseri is demonstrated by the high number of employees per company. with 355 million dollars in 2012's exports. The most significant center for the production and export of furniture in Turkey is Kayseri, which alone accounted for 18.7% of all furniture exports from Turkey.

After Kayseri, Izmir is ranked fifth in terms of employment level. The sector is concentrated in Karabalar and Kısıkköy Furniture City, and thanks to its port and accessibility, the city is making significant strides in exports. With 2.66 employees per company, the region has a lower employment level than the average for Turkey and is largely made up of small businesses.

New housing construction and income growth are the two main factors driving the demand for furniture. On the other hand, demand for office furniture is largely influenced by the opening and construction of workplaces, the use of office automation systems, and, obviously, the growth in employment. As a result, demand and capacity utilization rates for furniture, a consumer good with high demand elasticity, change in lockstep with changes in the economy.

The decline in domestic market demand is the main reason for the failure to raise capacity utilization. Insufficient domestic demand is the main factor preventing the sector from operating at full capacity, followed by insufficient foreign demand. Financial constraints, labor issues, and a lack of both domestic and imported raw materials follow the lack of demand.

TURKEY'S FOREIGN TRADE

The Turkish furniture industry has begun to consistently produce a surplus in foreign trade since 2001. Due to the crises that were experienced in the previous period, companies tried to overcome the decline in domestic demand by turning to exports. This process demonstrates that this situation is not a temporary orientation but has instead become our companies' preference. Exporting has evolved into the most significant force driving development and is no longer a process that is entered into with the breath of life.

More than half of the sector's imports come from the EU, and one-third of its exports are made to the EU. Despite being advantageous given the characteristics of the EU market and consumers, this regional concentration in the sector also highlights the need for market diversification (with alternative markets like the USA) in terms of the sector's long-term goals.

As of 2001, it is anticipated that the export process will remain positive, the sector will continue to make a significant contribution to the country's economy, and foreign trade will continue to have a positive balance. The furniture industry has the dynamism and potential for even greater increases under more favorable macroeconomic circumstances and with the experiences gained in foreign markets.

Export

Despite having many workplaces and producing a lot of jobs, the furniture industry only accounts for a small portion of our exports. In 2020, the sector's percentage of global exports was 2%. The growth of furniture exports is necessary for the sector's development. Turkey's exports of furniture increased significantly from 192 million dollars in 2001 to 3 billion 422 million dollars in 2020. 12% more furniture was exported in 2020 than the year before, despite the pandemic conditions, which had a significant negative impact on trade in that year.

Turkey's Furniture Exports by Products 1

While some businesses in the sector export their goods directly, the majority do so through other businesses, particularly contracting and architectural firms involved in international contracting projects. On the other hand, the number of businesses entering foreign markets directly through their own distribution channels has significantly increased in recent years.

Until the 1980s, the majority of exports were made to Middle Eastern nations; even so, after 1990, exports were primarily made to EU nations, CIS nations, and the Russian Federation. Parallel to the expansion of construction projects carried out in the Turkic Republics and the Russian Federation, there has been an increase in furniture exports to these nations. Furniture exports to the Russian Federation were unable to resume their pre-crisis levels due to the economic downturn that began in 1997. While exports to nearby and peripheral nations have grown recently, the proportion of exports to EU nations to overall furniture exports has been declining. In terms of market diversification, this trend can be viewed as advantageous.

The largest market for Turkey's furniture exports since 2020, according to an analysis of the countries, has been Iraq. With exports totaling $484 million in 2020, there was a 5.3% drop in our exports to this nation from the previous year.

Germany, Saudi Arabia, the United States, France, the United Kingdom, Israel, and Libya are additional significant markets for the furniture Turkey export. The failure of exports to reach the desired levels is largely due to the pandemic conditions, political issues in neighboring and neighboring countries, as well as the inadequate use of modern and design-oriented production. Other significant issues with exports include funding issues and a lack of knowledge about foreign markets, especially for medium- and small-sized businesses.

Turkey's Furniture Exports by Countries 1

Import

The number of furniture imports increased in 1986 as a result of the further liberalization of imports and our accession to the Customs Union in 1996. Furniture imports were roughly 38 million dollars in 1994; the following year, they rose by 79% to roughly 68 million dollars. This rapid rise in imports persisted in the years that followed, but in 2001, as a result of the crisis, furniture imports fell to 122 million dollars, a 40% decrease from the previous year. With a slight increase in 2002, the post-crisis decline in furniture imports was realized as a 128 million dollar drop. The sector's imports grew steadily over the years in step with the economy's recovery, but in 2009, as a result of the world financial crisis, they fell by 37% from the year before and totaled $568 million. The sector's imports surpassed 2008 values and totaled $941 million in 2011 when the crisis' effects were significantly diminished. We imported 498 million dollars worth of furniture in 2020, a 9.1% decline from the previous year. Positively influencing the sector's foreign trade surplus is the decline in imports. Turkey's Furniture Imports by Product 1

China and EU nations are the main sources of furniture imports for Turkey. The country importing the most furniture as of 2020 is China, with 69 million dollars, followed by Poland with 57 million dollars. Italy, Germany, Romania, and Bulgaria are other notable importers of furniture from which Turkey imports goods. The acceptance of these nations, which are the biggest producers and exporters in the world, shows that Turkey has a sizable population that can afford cutting-edge furniture. Other wooden furniture, other metal furniture, other metal furniture, other metal-framed stuffed seating furniture, other wooden-framed stuffed seating furniture, and other metal-framed non-filled seating furniture are the main product groups Turkey's import.

Turkey's Furniture Imports by Countries 1

World Trade

The main change in the international trade of furniture in recent years has been the acceleration of the globalization of the furniture market. The USA, the EU, and China are the major players in the global furniture markets, with a furniture foreign trade surplus of about 56 billion dollars and a furniture foreign trade deficit of close to 47 billion dollars respectively. The USA exports furniture worth over 70 billion dollars.

Export

The global economic crisis caused the world's furniture exports, which were 66.5 billion dollars in 2002, to increase to 140.2 billion dollars in 2008 before falling to 115.5 billion dollars in 2009. When compared to the prior year over the previous ten years, exports increased by an average of 4.5% in 2017, 2018, and 2019, reaching 194.4 billion dollars in 2019. Exports decreased in 2015 and 2016 compared to the prior year. The rate of exports of furniture is expected to slow down in 2020, but there may be a slight increase.

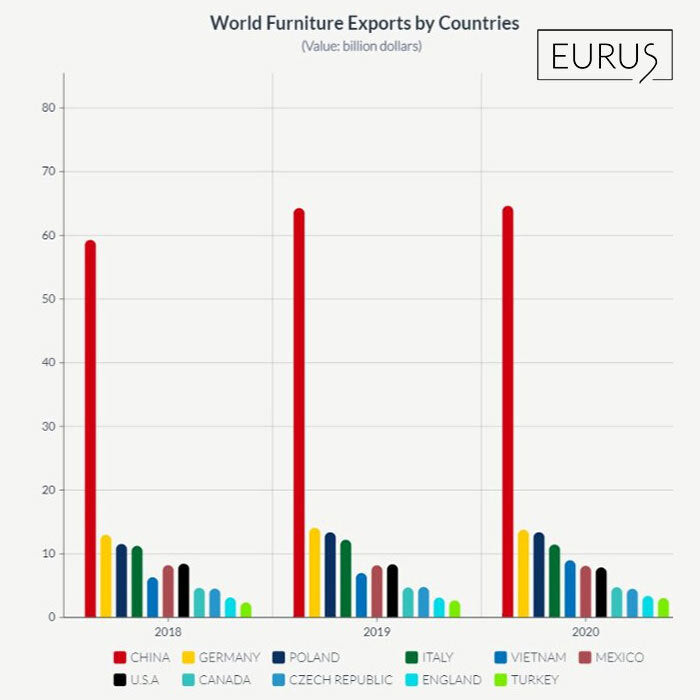

China exports furniture at a rate of one-third of the global total. Around one-third of all furniture exports worldwide come from EU nations as well. Furniture manufacturing has a strong global competitive position and is a fundamental industry in many EU nations. The next three biggest exporters are China, Germany, and Poland. Other important nations that export furniture include the Netherlands, Austria, France, Denmark, Belgium, Sweden, Denmark, and Denmark. The highly specialized furniture market in the EU has numerous subsectors. Kitchen furniture and upholstered furniture are the two biggest production categories. The transit trade of wooden furniture is another significant sector for EU nations. As of 2019, Turkey's share of global furniture exports was 1.57%.

World Furniture Export by Countries 1

Imports

Despite the fact that global imports of furniture have been rising over the past 20 years, declines from the year before can be seen in 2009, 2015, and 2019. With a total value of 189.5 billion dollars in 2019, global furniture imports decreased by 1.4% from 2018.

The USA imports furniture at the highest rate in the world. With imports totaling 56 billion dollars in 2019, the USA alone was responsible for 30% of all furniture imports worldwide.

Germany is the biggest importer nation after the United States. In 2019, Germany brought in 15.8 billion dollars worth of furniture, accounting for 8.1% of global imports. The UK, France, Canada, Japan, Japan, the Netherlands, and Spain are additional significant importers.

World Furniture Imports by Countries 1

The top EU furniture consumers are Germany, France, the Netherlands, and Spain. These nations' open, well-traveled, multicultural populations have a bearing on the characteristics of various cultures in terms of furniture consumption. The most popular product categories on the EU furniture market are upholstered seating groups (sofas and armchairs) and kitchen furniture. In the upcoming years, the EU furniture market's growth is anticipated to slow. However, it is anticipated that the transition from traditional to modern furniture will continue and that there will be an increase in the variety of furniture designs and styles. The fact that individual furniture pieces that can fit into existing furniture groups are increasing their market share relative to purchases of furniture in sets is another significant aspect of the EU consumption pattern.

Regarding the consumer demographic, an increase in the preference for contemporary furniture among people over 45 who are single is anticipated. Furniture product structuring that favors high quality at a lower cost and low quality at a higher cost is also anticipated to rise.

Trends in the EU wood furniture market suggest that companies trying to enter this market and looking for a new market segment should concentrate on bedrooms and other home furnishings. While cherry, teak, and other dark-toned woods are in demand, consumer preferences are shifting towards lighter shades of wood, beech, maple, and birch. New trends are nostalgia and warm tones and designs that emphasize local elements in modern furniture. There is a return to solid furniture from laminate and veneer. Furniture is becoming more multipurpose/functional, comfortable/comfortable, and flexible. With the EU's growing elderly population, the importance of ergonomics in furniture is increasing